This post was written by Pia Morante, a second-year Duke MBA student, CASE i3 Fellow, and a member of the Fuqua chapter of the Net Impact Club in April 2017.

This month we had the pleasure to welcome Alvaro Rodriguez Arregui, CASE i3 Advisory Board member, to Fuqua. Alvaro is Co-Founder and Managing Partner of IGNIA Partners, a venture capital firm that invests in innovative solutions for the emerging middles class in Mexico.

Founded in 2007, IGNIA has two funds with US$200 million assets under management. IGNIA’s innovative approach is to invest in businesses that are addressing an unmet demand in the emerging middle class or that bring a better value proposition for a basic need. In that sense, IGNIA seeks to create a more inclusive Mexico by providing capital and supporting entrepreneurs who are building efficient companies that serve the Mexican emerging middle class. IGNIA invests across many sectors, including: healthcare, financial technology, financial services, education, and basic services.

During Alvaro’s visit he spoke to students about how partnering with entrepreneurs serving the emerging middle class in Mexico allows IGNIA to not only build very successful businesses, but also create a huge social impact in the communities in which they invest.

Three notable takeaways from his visit are:

Latin America has a unique ecosystem, therefore it is very difficult to replicate business models in other emerging economies.

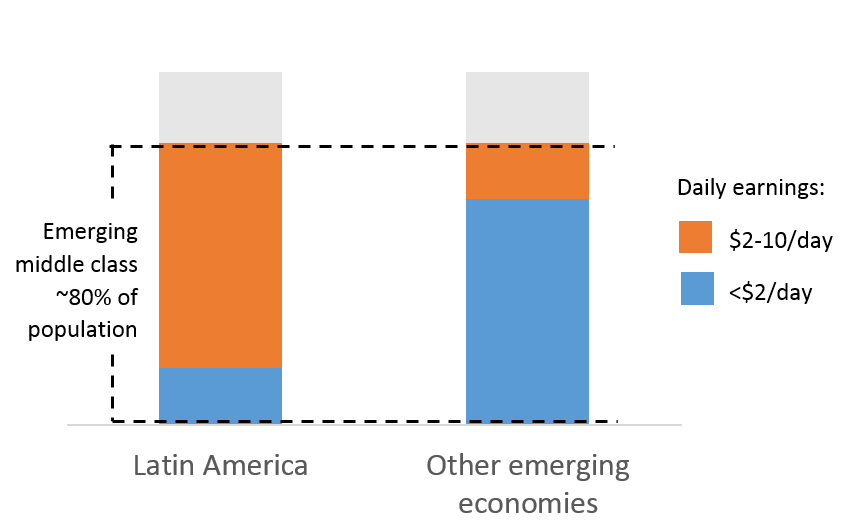

Alvaro explained that although the emerging middle class represents around 80% of the population across most emerging economies, the composition of that emerging middle class can be completely different among the different economies. In Latin America, 80% of the emerging middle class earns between US$2 and US$10 per day, whereas the remaining 20% earns less than US$2/day. In other emerging economies, this composition is completely flipped. Therefore the challenge of serving the emerging middle class can differ significantly, making it very dangerous to try to replicate business models across emerging economies.

Moreover, Alvaro explained that IGNIA is primarily focused on investing in businesses that serve the segment of the population that earns between US$2 and US$10 per day. The main rationale behind this is that they seek self-sufficient business models, capable of competing in the Latin American market and that can grow steadily.

Big businesses cannot reinvent the whole bottom of the pyramid (BoP) value chains, but entrepreneurs can.

Alvaro emphasized that the biggest problem in Latin America is the lack of quality products and services available to the emerging middle class. IGNIA’s approach to solving this problem is to invest in entrepreneurs that have the creativity to reinvent the value chain for products and services to meet the needs of the emerging middle class. Alvaro believes that large corporations usually have a more established mindset that is very difficult to adapt to serve this segment of customers.

To exemplify this, he referred to the prescription eye glasses industry. In Mexico the average price of prescription eye glasses is US$100, so major manufacturers design their value chain based on that price and on a target gross margin. Serving the emerging middle class with US$20 eye glasses is impossible with a value chain designed for US$100 eyeglasses. But entrepreneurs serving the emerging middle class start with the US$20 price tag that is affordable for this sector of population and design a new value chain that maintains margins so the business can scale. , Alvaro emphasized maintaining competitive margins is important because there is scarce commercial capital willing to fund low margin businesses to scale.

Invest in business models that do not imply a change in consumer behavior and in entrepreneurs who have the right management capabilities to run a business.

A key lesson learned that Alvaro shared with us is the difficulty of investing in business models that imply a change in consumer behavior, unless investors have a much longer investment horizon. The reason behind this is that it is very difficult to predict not only how consumers will react to products or services that require them to change their behavior, but also how long it will take them to adapt. Moreover, Alvaro recommended to always seek entrepreneurs who have not only the right technical skills but also the right management capabilities to run a business. While VC investors play a key role in supporting their portfolio companies to ensure their growth and success, they cannot be involved in the day-to-day operations. Therefore, the role of the management team is key to ensuring success.

Alvaro closed out his speech with a last reflection. The Latin American venture capital industry is still very young, and the amount of money invested in ventures is still very small compared to what these companies really need to scale and achieve successful exits for their investors. Therefore, the only way to continue to develop this industry meeting the needs of the emerging middle class is to scale the capital available to them.

Finally, I would like to say that, as a Latin American citizen, I personally believe that the impact investing field is off to a promising start in Latin America, and I am looking forward to discovering how entrepreneurs will continue to become capable of attracting increased flows of capital as they scale their businesses and create a huge impact in our communities.

About Pia Morante:

Pia has a background in asset management working in the Investments team of a Peruvian pension fund and is very passionate and excited about growing her career in the impact investing space. Since she started at Fuqua, Pia has been very involved in our CASE Initiative on Impact Investing. As a CASE i3 Fellow, Pia is currently leading a consulting project with an impact investor, which is helping her to immerse herself in this industry. Pia’s goal is to leverage these experiences to grow the impact investing field in Latin America.